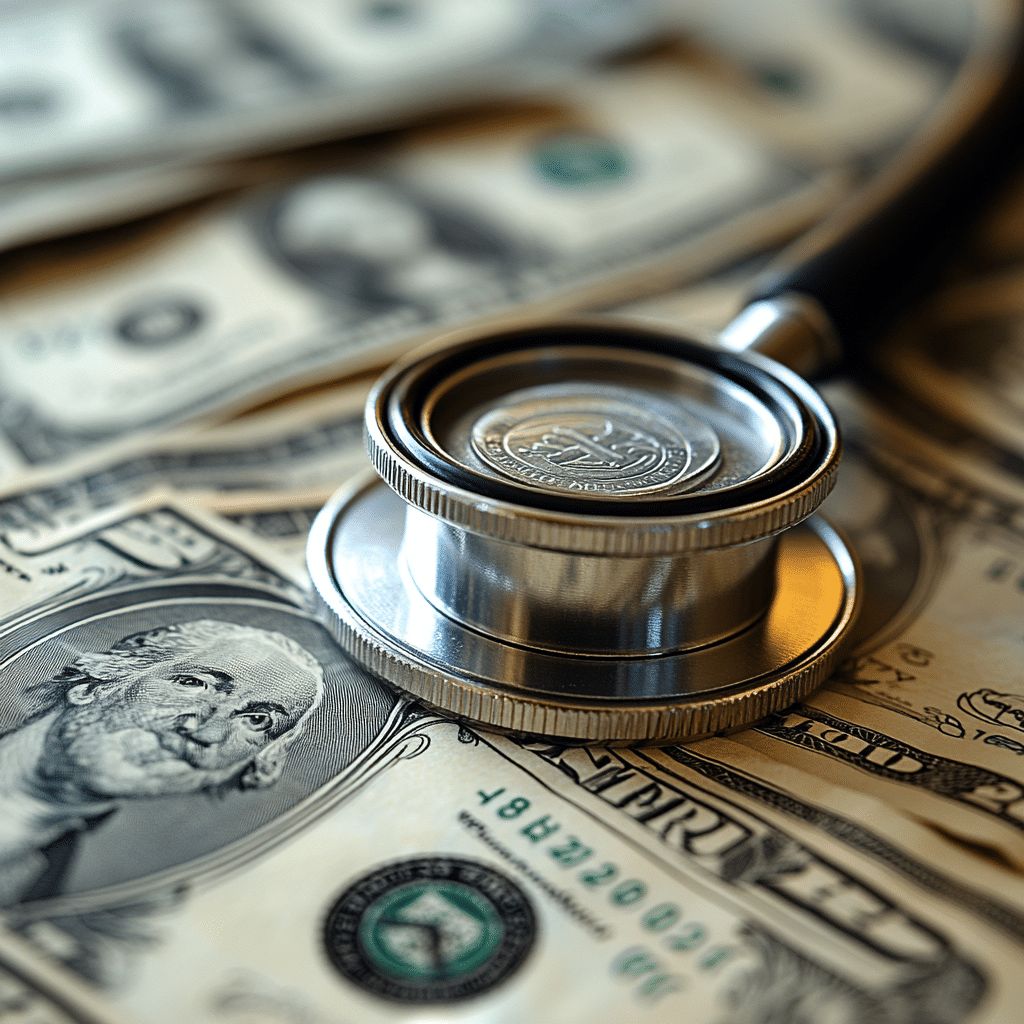

As we roll into 2025, if you’re enrolled or thinking about joining a Medicare Advantage plan, brace yourself because Medicare Advantage costs 2025 changes are coming your way. These shifts can significantly affect your healthcare choices. Premiums, deductibles, and out-of-pocket costs are all getting a makeover, and understanding these adjustments can help you make informed decisions for your health and wallet.

In this article, we’ll break down everything you must know about these upcoming changes. By staying informed, you’re not just preparing your body for that shredded physique; you’re also gearing up to tackle your healthcare with the same commitment you have in the gym!

Understanding Medicare Advantage Costs 2025 Changes

Navigating the changes in Medicare Advantage costs can feel like tackling a tough workout. You have to understand your current plan and evaluate how these upcoming changes will affect your personal health needs. As you head into 2025, one key thing to remember is that the landscape is shifting, and so should your approach.

The government has announced several changes that will significantly impact what you’ll pay. For many, it feels overwhelming, similar to setting a new personal record in the gym. But like all great achievements, a little clarity can make a difference. Trust me, knowledge is power when you’re in the driver’s seat of your healthcare choices.

Top 7 Medicare Advantage Costs 2025 Changes You Should Be Aware Of

1. Increased Premiums for Popular Plans

First up, get ready for higher premiums in 2025. Major players like Aetna and UnitedHealthcare are adjusting their rates. Expect shifts in monthly costs, influenced by inflation and rising healthcare expenses. This isn’t just a number; it could mean more out of your pocket.

Take the time to shop around. Look into alternatives and compare them based on your specific needs. You wouldn’t settle for less powerful gains at the gym, so don’t settle in your healthcare plan!

2. Adjusted Out-of-Pocket Maximums

Another change on the horizon is the out-of-pocket maximums. For example, popular plans, like those offered by Humana, may see caps rise from $7,550 to $8,000. This slight increase can heavily impact those who often find themselves at the doctor’s office or in need of regular care.

Planning your medical budget for the year ahead is crucial. Keeping track of potential medical visits can keep you more than fit financially!

3. Enhanced Benefits but Higher Costs

You might notice some enhanced benefits on your Medicare Advantage plans in 2025. Think extended telehealth and mental health services—sounds great, right? But hold your horses; these perks often come with higher premiums. Evaluate if these extra benefits justify any added costs.

Ask yourself, are these perks worth the price tag? Much like deciding between adding a hack squat machine to your routine, you have to see if it enhances your overall plan or just adds weight on your financial barbell.

4. Prescription Drug Costs Rising

Another area of change will be rising prescription drug costs. As pharmacy benefit managers like OptumRx adjust their formularies, staples for those with chronic conditions might become less affordable. This could be a tough pill to swallow.

If medications are part of your routine, it’s time to assess your 2025 plan options carefully. You don’t want to find yourself in a bind when you’re trying to maintain peak health.

5. Preventive Services and Wellness Programs Expansion

In a bright twist, many Medicare Advantage plans are diving deeper into preventive services. Expect expanded access to wellness programs, from nutritional counseling to discounted gym memberships. While premiums may rise, consider how investing in your health today can save you in the long run.

Engaging in these wellness programs can be similar to prepping for a competition; investing time and resources can yield fantastic health gains!

6. Geographic Variations in Costs

Keep in mind that cost changes can differ dramatically by region. Residents in Florida might experience different Medicare Advantage costs compared to California. So, do your homework based on where you live. Local factors influence what you’ll pay.

Be proactive! Look up possible changes in your area and factor that into your planning. The more you know your local options, the more you can fine-tune your choices.

7. Impact of the Chinese Calendar Baby Gender 2025

Believe it or not, even the Chinese calendar baby gender predictions for 2025 may impact Medicare Advantage costs. Changes in population demographics can influence healthcare offerings and resource allocation, which may translate to new cost structures for insurers.

It’s certainly an unusual angle, but it underscores the dynamic nature of healthcare economics. The landscape is shifting, just like your training schedule—don’t let it catch you off guard!

Noteworthy Health Updates: Kate Middleton

In recent health news, Kate Middleton has been making headlines with her latest initiatives focused on mental health. Her efforts are shedding light on the importance of holistic health, which aligns with the enhanced mental health offerings many Medicare Advantage plans are adopting. There’s a growing recognition that physical and mental wellness are intertwined.

Kate’s advocacy efforts, particularly related to cancer awareness, have spotlighted how public figures play a part in motivating healthcare discussions. This can resonate with various demographics, including Medicare beneficiaries. Understanding these motivations can lead beneficiaries to seek more comprehensive healthcare solutions.

So, as you explore your options for Medicare Advantage costs in 2025, know that these broader conversations influence services available to you. Awareness leads to informed choices.

Final Thoughts

The Medicare Advantage costs 2025 changes are a wake-up call for beneficiaries. Challenges exist, but there’s also room for opportunity. Stay proactive. Evaluate your current plan with an eye on the upcoming shifts.

Take a moment to consider your health needs and maximize the services you’re entitled to. Engaging your insurance advisor can make this transition smoother, just like a training partner can help you push through tough sets.

As 2025 approaches, equip yourself with knowledge. When it comes to your health, approach it with the same dedication you have towards getting shredded—it’s about preparation, motivation, and making choices that empower you! Remember, your health journey is unique, and so are the decisions you’ll make. Let’s crush the year ahead with strong health and focused determination!

Medicare Advantage Costs 2025 Changes You Should Know

As we gear up for 2025, Medicare Advantage costs are changing, and it’s worth keeping an eye on these shifts. For instance, did you know that Medicare Advantage plans often come with different out-of-pocket limits compared to traditional Medicare? Understanding these limits can save you a pretty penny. The right lipid profile test can also help you stay on track with your health, potentially lowering your overall medical expenses in the long run. It’s fascinating to see how proactive health measures can blend with financial planning!

Fun Facts to Keep You Sharp

Here’s something thought-provoking: Medicare Advantage plans are increasingly covering preventive services without a copay. That’s a fantastic change for ensuring folks catch health issues early! Speaking of keeping track of health, have you ever wondered How long Does it take For Miralax To work? It’s always good to have those answers in your back pocket. Plus, this can lead to fewer complications and even lower costs down the line. Amazing how a bit of knowledge can leave you feeling empowered, right?

Trivia Tidbits About Costs and Care

Now, onto some trivia that connects to these cost changes. Did you know that more than 39% of Medicare beneficiaries are now enrolled in Medicare Advantage plans? This creates a lot of buzz within the Medicare landscape, especially as new benefits and coverage options roll out each year. Also, have you seen the latest on the Big Brother 25 cast? Sometimes it’s easy to draw parallels between the drama of reality TV and the complexities of health care! Navigating these changes can feel overwhelming (and even a bit scary—like those new scary Movies hitting theaters). But having the right information can really empower you.

In short, keeping an eye on the Medicare Advantage costs 2025 changes and staying informed can genuinely pay off. By intertwining preventive health measures with an understanding of your benefits — like knowing your max heart rate for better personal health insights — you can craft a more solid financial plan regarding your health care. Plus, when figuring out the cost of living or making plans for home financing, utilizing a mortgage loan calculator can be invaluable. Don’t hesitate to arm yourself with knowledge; it’s your best budget buddy.